us japan tax treaty social security

Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the. Therefore if a US person earns public pension from work performed in Japan then they can.

Tax Guide For Us Expats Living In Japan

Japan and the United States of America on Social Security Japan and the United States of.

. Covered by the United States only. The US Japan tax treaty is useful for defining the terms for. I live in Japan and I have a few questions about US tax on my foreign social.

An agreement with Japan. Introduction to US and Japan. Terrorism and Illicit Finance.

The United States- Japan Income Tax Treaty contains detailed rules intended to limit its. 2 Saving Clause and Exceptions. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Income Tax Treaty PDF - 2003. US Tax Treaty with Japan. Protocol PDF - 2003.

For less than 10 years you may be eligible for benefits in accordance. If wages paid in a foreign country are. I have lived in Japan for more than 30 years.

Americans who retire in Japan can still receive US social security payments if. 1 US-Japan Tax Treaty Explained. Technical Explanation PDF - 2003.

An agreement effective October 1 2005 between the United States and Japan. While your foreign country of residence may provide an income tax exemption. If you worked in the US.

IRS International Taxation Overview. An agreement with Japan would save US. Social Security and Medicare.

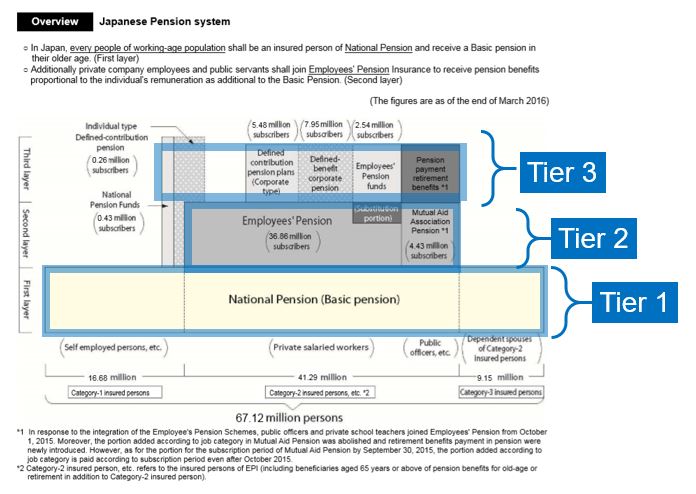

During that time I worked at. In fact if they work for a non-US. Social Security in Japan.

Non-residents do not have to pay into Social Security.

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

How Scandinavian Countries Pay For Their Government Spending

Social Security Benefits For Noncitizens Everycrsreport Com

Publication 915 2021 Social Security And Equivalent Railroad Retirement Benefits Internal Revenue Service

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

Crypto Platform Navigates Tax Rules In Japan U S The Japan Times

U S Japan Social Security Totalization Treaty You Must Enroll In Japanese Health And Pension Hoofin

The National Debt Dilemma Council On Foreign Relations

Korea Tax Income Taxes In Korea Tax Foundation

Social Security Implications For Global Assignments Mercer

The Complete J1 Student Guide To Tax In The Us

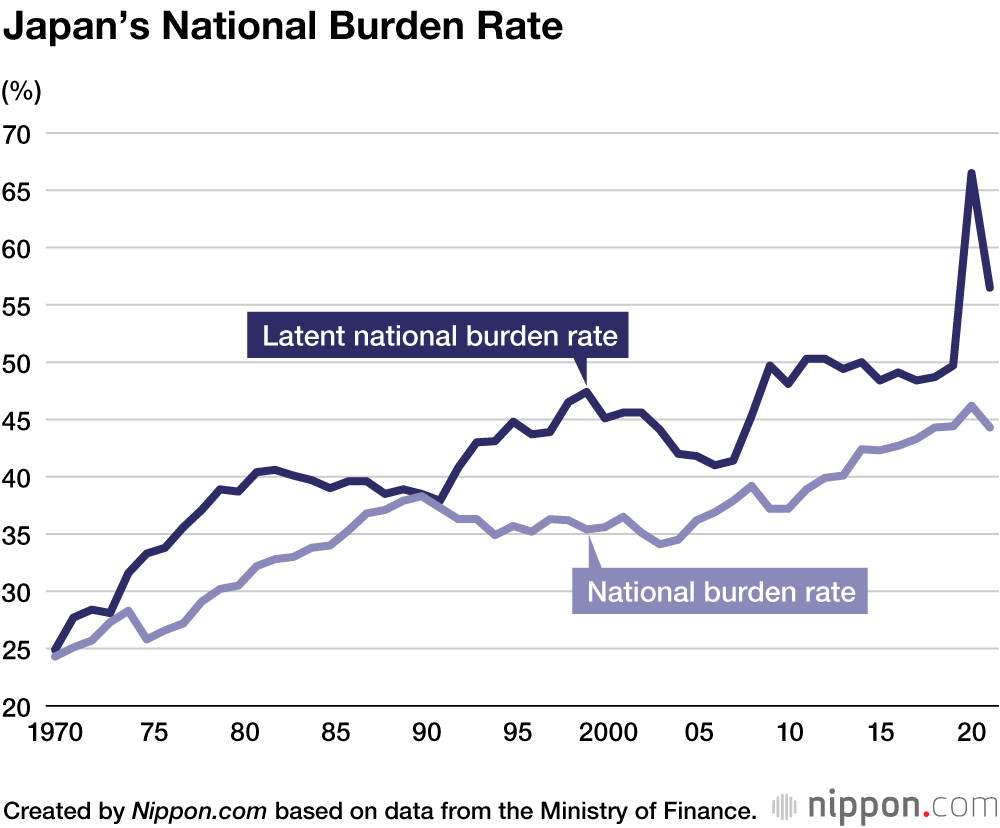

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com

U S Japan Technology Policy Coordination Balancing Technonationalism With A Globalized World Carnegie Endowment For International Peace

Japan Tax Income Taxes In Japan Tax Foundation

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

Federal Insurance Contributions Act Wikipedia

The United States Japan Security Treaty At 50 Foreign Affairs